Built for Global Customers

Trusted KYC Verification & Risk Management Solution

Reliable, instant online identity verification. Verify customers online, anywhere, in seconds

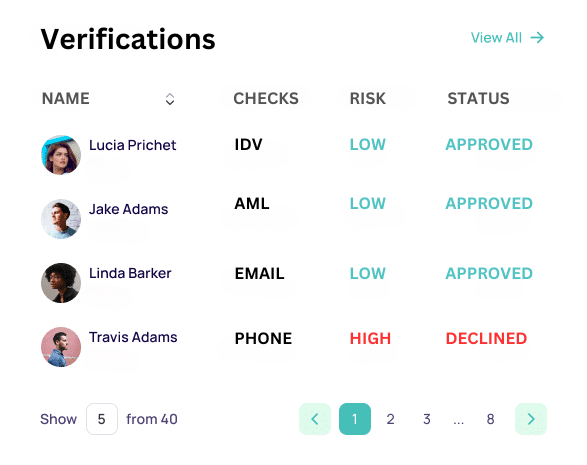

Secure your Customer Journey

A powerful KYC verification platform

Simplify all aspects of your customer journey, from KYC verification and onboarding to in-app transactions and ongoing account activity.

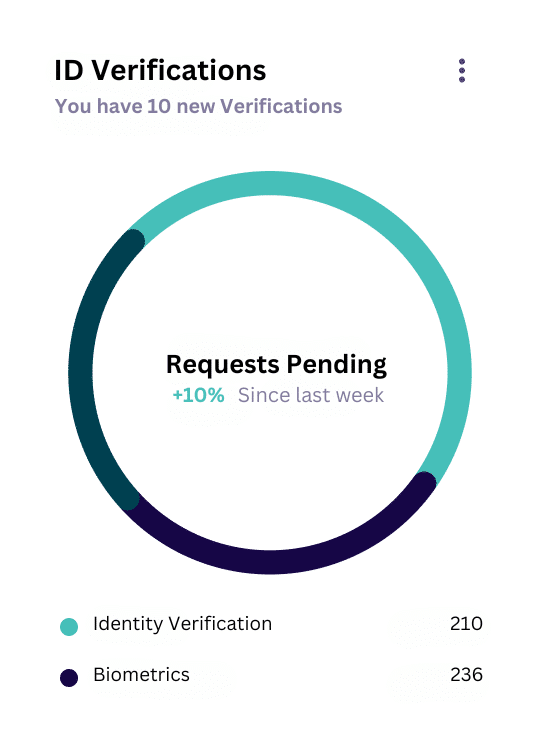

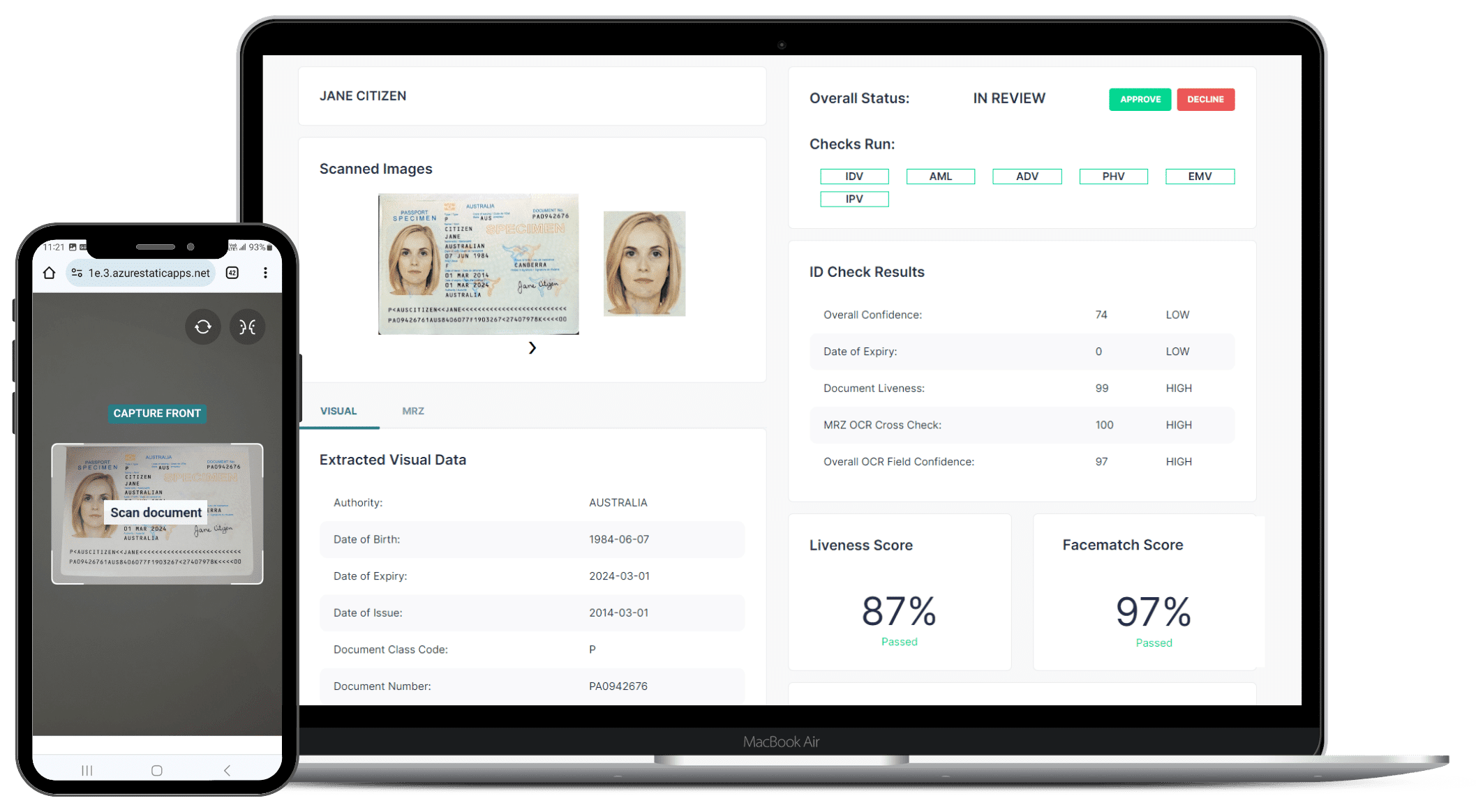

ID Authentication & Biometrics

Verify identity documents in real time. Detect deep fakes and match faces to IDs in seconds.

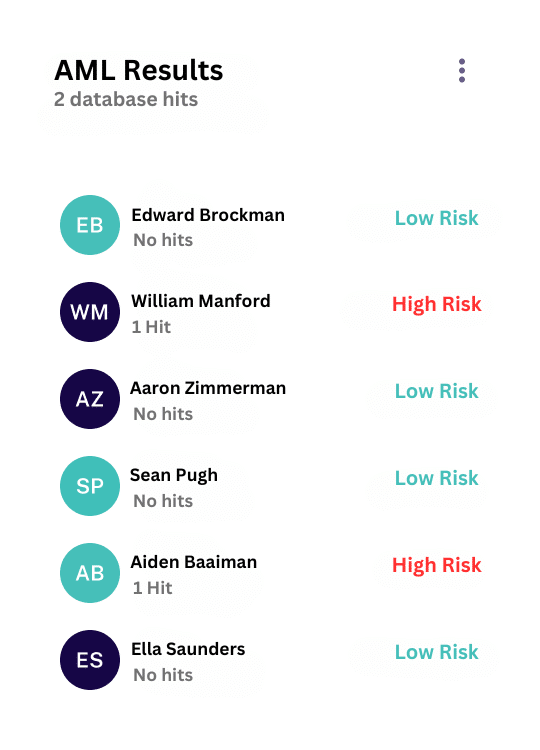

AML Screening

Monitor and protect at every turn. Screen individuals and businesses against sanctions lists, politically exposed persons and global watch lists.

Customer Intelligence

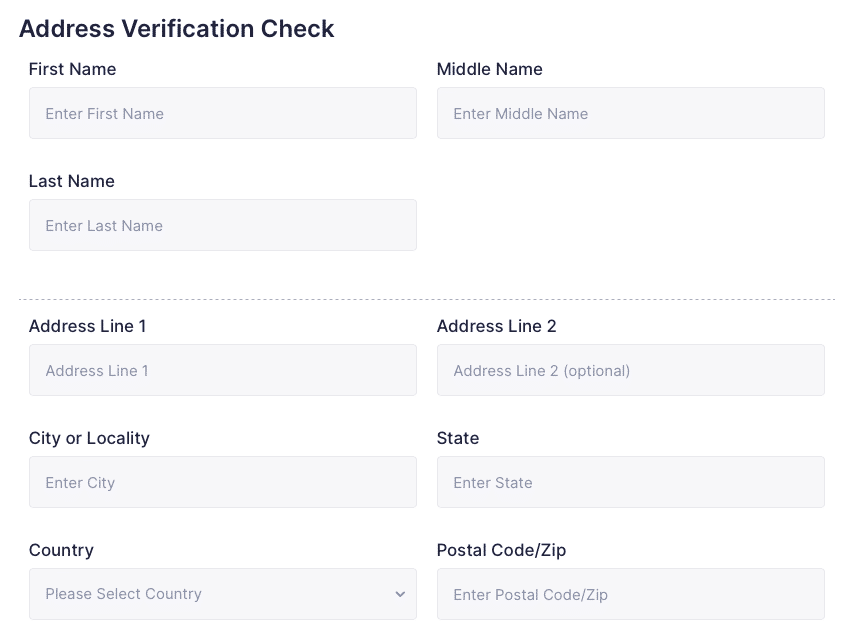

Gain insights around address verification, social media profiling, phone and email records, device and connection fingerprinting.

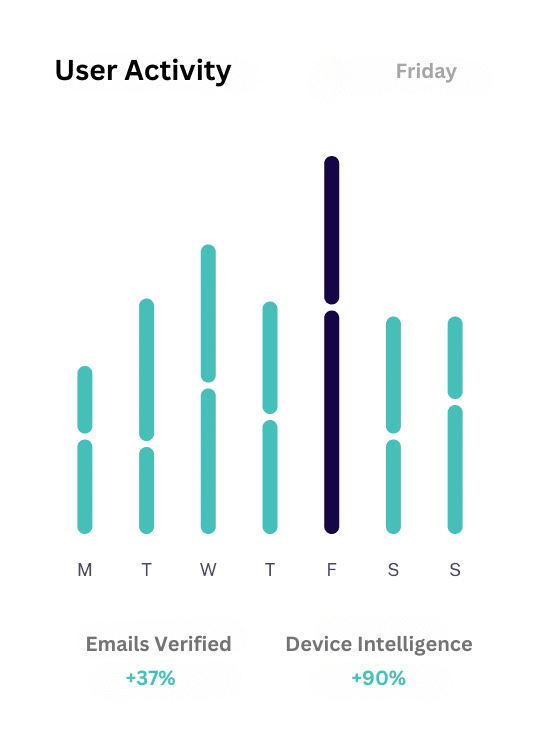

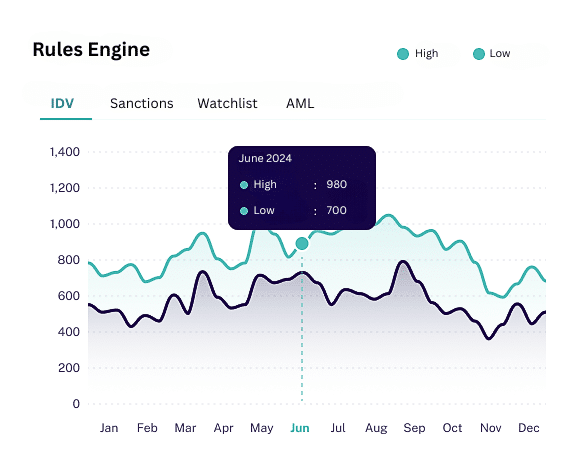

Smart Monitoring

Intelligent decisions made for you

Automated risk assessment that adapts to evolving conditions and minimizes manual intervention.

Return on Investment

The cost of not taking action speaks loudly

With global fines for compliance failures in banking alone reaching nearly $5 billion in 2023, can you afford not to take action with ScreenlyyId's robust KYC verification solutions?

The global cost of fraud to businesses and individuals each year

The average annual revenue organizations lose to fraud each year

Increase in global fraud costs to individuals and business over the last decade

Reduce Operational Costs with Automation

KYC verification designed for scalability

Automate identity verification workflows and minimize costs. Scale your operations without compromising compliance accuracy.

Real-Time Alerts and Decision-Making

Risk management solution to stay ahead of threats

Stay updated with instant alerts on suspicious activities. Respond quickly with tailored fraud prevention tools.

More Features

Unleash advanced KYC verification capabilities

Experience real-time analytics, no code integrations, advanced risk assessment, and powerful APIs to manage your organizations KYC Verification.

Plans & Pricing

Choose a pricing plan that works for you

Whether you're an individual, a small team, or a growing enterprise, we have a plan that aligns perfectly with your goals.

Any ID Anywhere

The worlds largest Identity Document database

With access to 14000 Identity Document templates from 250 countries, identify customers and prevent fraud before it happens.

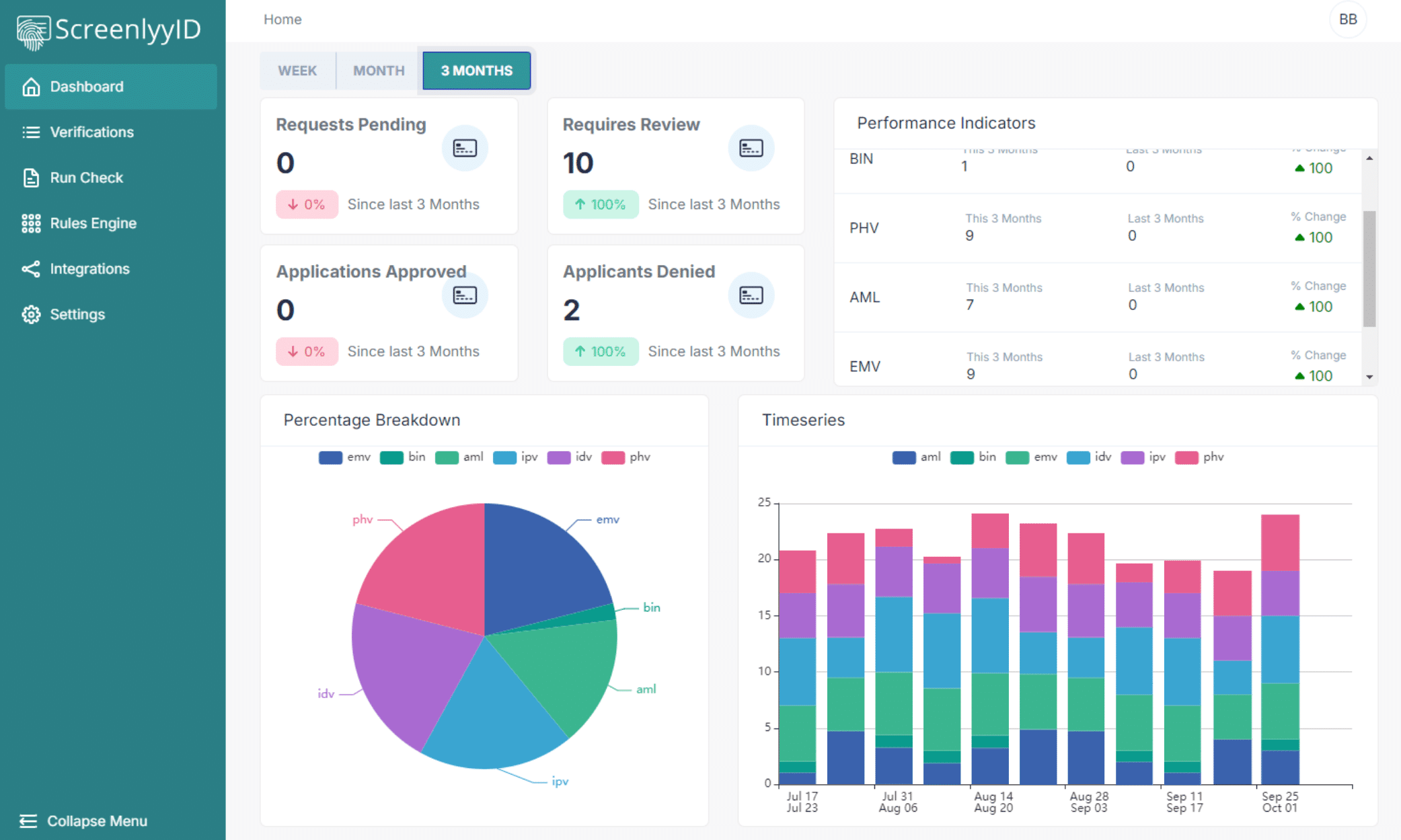

Simplified eIDV Process

No-Code, Bulk CSV, API, or live lookup, we’ve got you covered

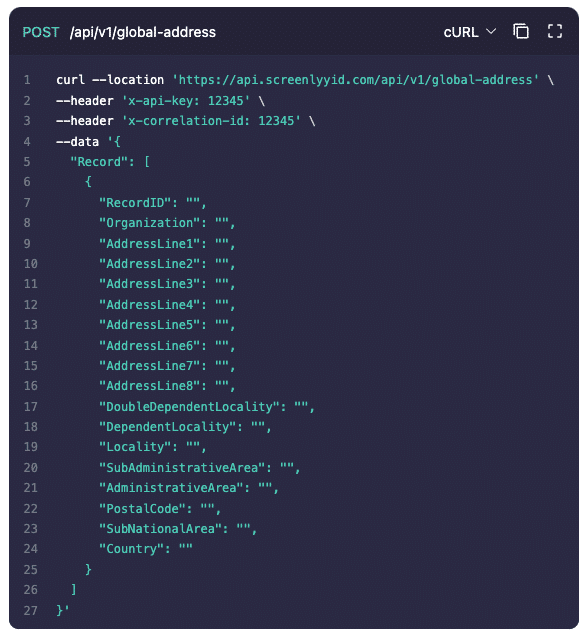

ScreenlyyID's dashboard and API suite offers flexible integration options. You can conduct bulk verifications via CSV in the dashboard, integrate the API into your own systems, or send a no-code UI form to prospects for easy completion.

Frequently Asked Questions

We're here to answer all your questions

Everything you need to know about ScreenlyyID's Identity and KYC Verification solutions. Can’t find the answer you’re looking for? Please chat to our friendly team.

KYC verification ensures businesses verify customer identities to meet Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. It reduces fraud risks.

ScreenlyyID offers automated tools that streamline customer onboarding, detect risks, and ensure compliance with global regulations.

ScreenlyyID's KYC verification solution fulfils legal obligations, helps prevent financial crimes, and safeguards businesses from penalties for non-compliance.

ScreenlyyID's KYC and identity verification solution benefits banking, telecoms, e-commerce, fintech, sharing economy and any sector requiring customer identity verification screening.

ScreenlyyID's comprehensive KYUC verification solution, combines data analysis, machine learning, and fraud detection to proactively identify and mitigate risks.

Yes, our flexible APIs ensure seamless integration with your current platforms and workflows.

ScreenlyyID offers an all-in-one identity and KYC verification platform with robust AML compliance tools and customizable features. All through one intuitive dashboard and set of API's.

Contact Us

Talk to an expert

Let's connect to discuss the possibilities and find the perfect solution for your business needs.

Complete the form, and one of our experts will reach out to you. You'll discover how our solutions can tackle your specific challenges, optimize your operations, and drive your growth.

- Explore industry-specific use cases

- Identify the best solution for you

- Get enterprise pricing

- Book a demo

Start Today

Start Verifying Customers Today

See how easily ScreenlyyID integrates verification into your onboarding process.

- Free Forever

- No Set Up Fees

- No Licencing Fees

- No Hosting Fees