- Home

- Remote Identity Verification

End-to-End Digital Identity Verification

Effectively verify new customers in seconds, safeguarding your business from identity fraud

- Setup in Minutes

- No Credit Card

- Cancel Anytime

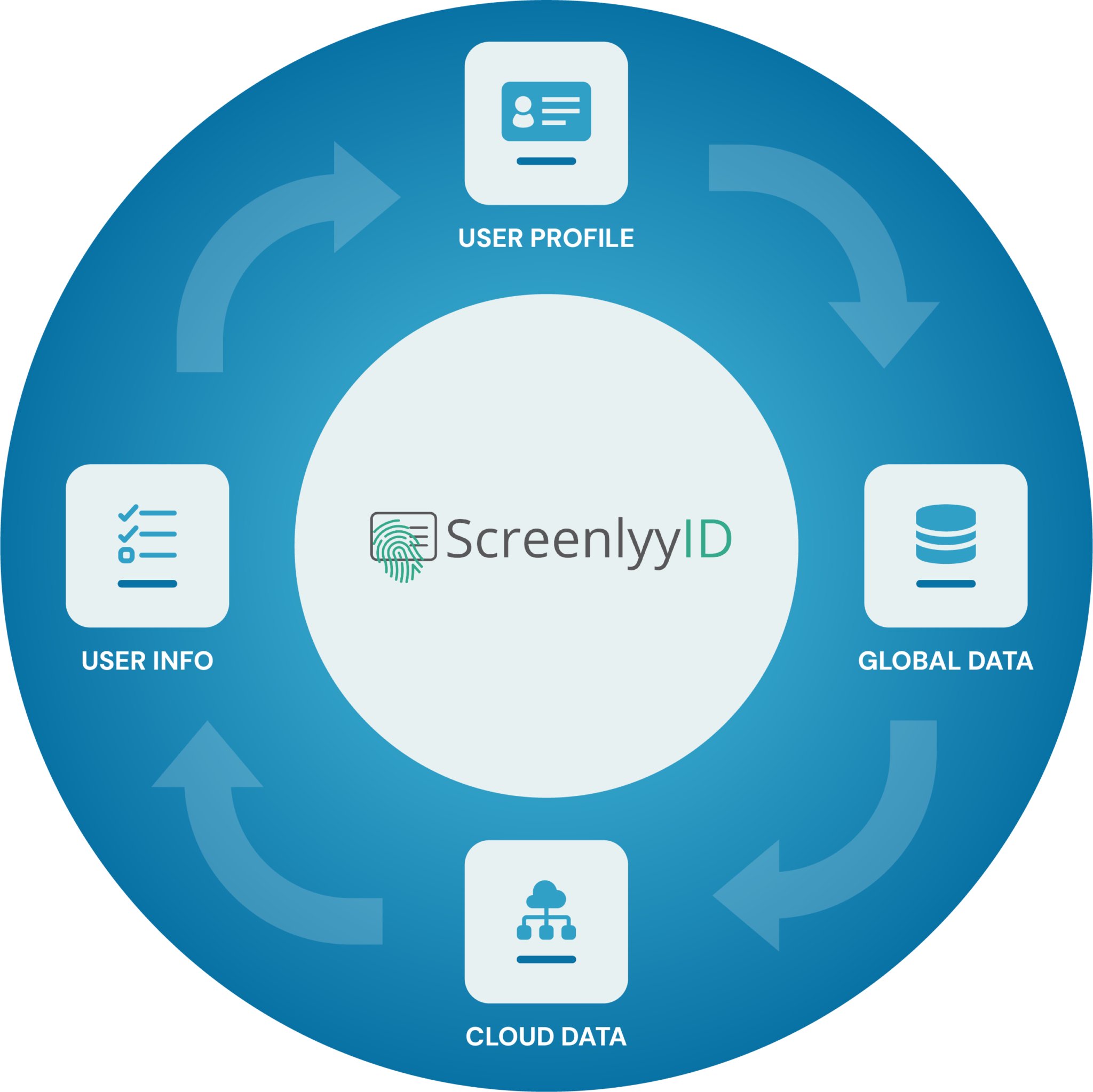

Comprehensive Customer Insights

Digital identity verification, offers

a 360° view of customer identity

Digital identity verification, powered by advanced AI, is designed to detect and prevent any malicious activity, allowing you to focus on running your business without worrying about fraud attacks.

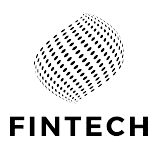

Digital Identity Verification

Streamline customer onboarding with speed, security, and ease.

ScreenlyyID's AI-driven identity verification detects fake and tampered documents in real-time, reading over 14,000 IDs from 245+ regions with a single photo.

- Flexible Solution

- Constant Updates

Return on Investment

The cost of not taking action speaks loudly

With global fines for compliance failures in banking alone reaching nearly $5 billion in 2023, can you afford not to take action with ScreenlyyID's robust KYC verification solutions?

The global cost of fraud to businesses and individuals each year

The average annual revenue organizations lose to fraud each year

Increase in global fraud costs to individuals and business over the last decade

Know Your Customer

Digital identity verification for

assured customer legitimacy

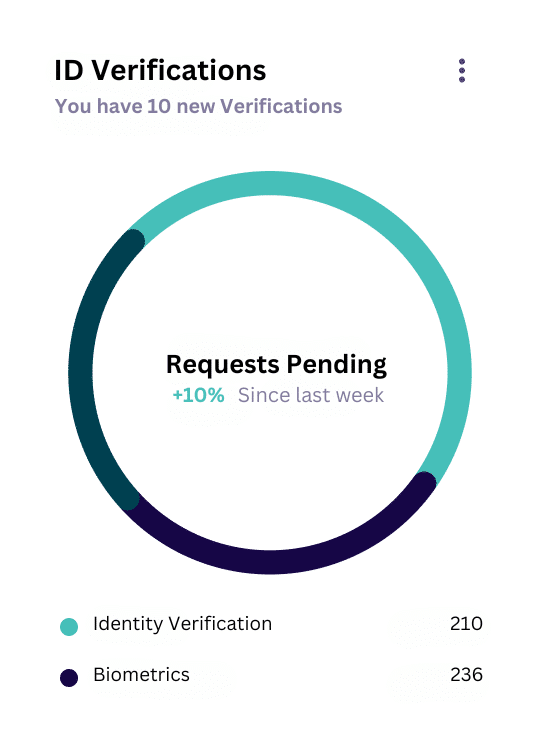

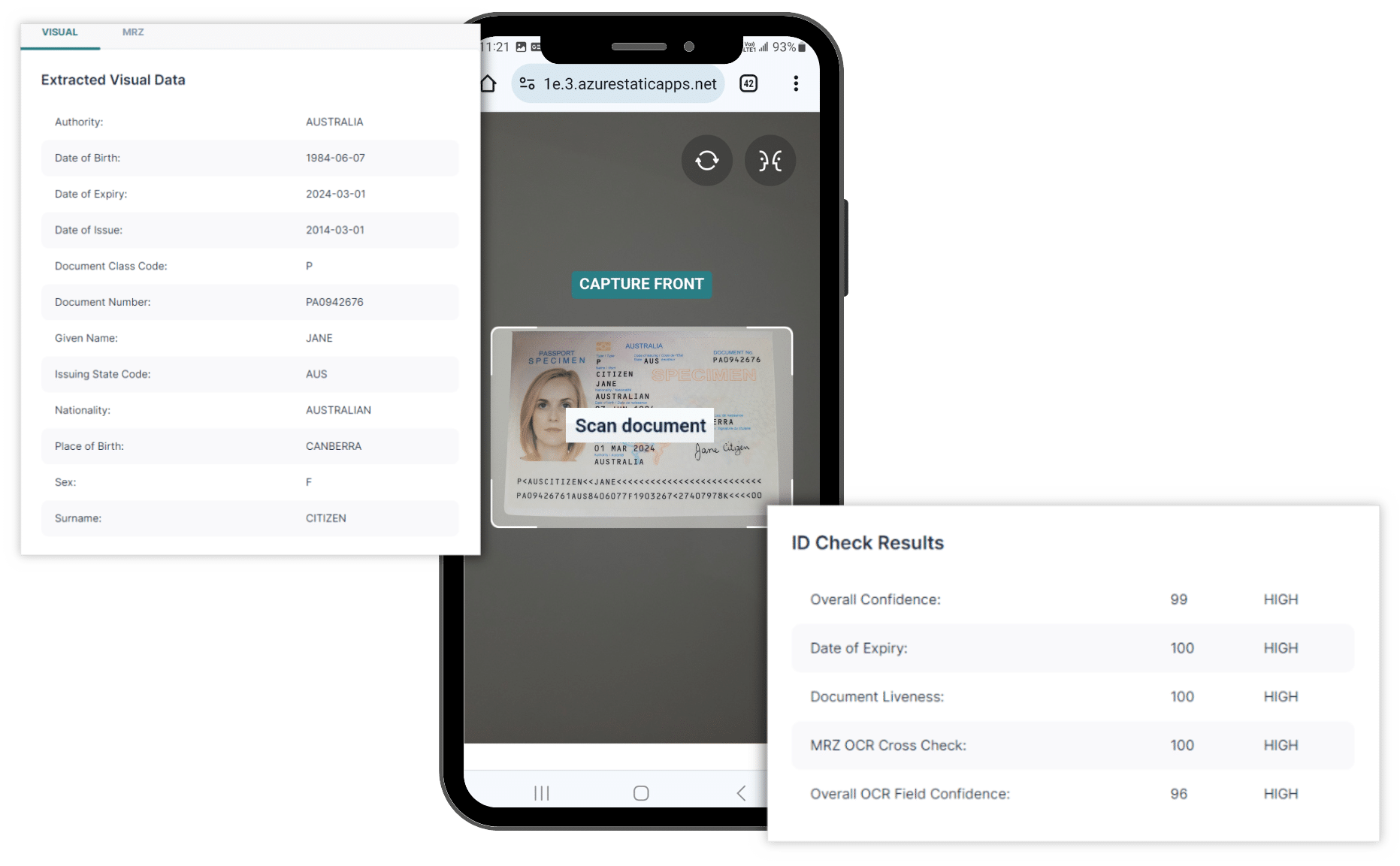

Document Authentication

Verify identity documents in real time. Detect fake and tampered documents.

Biometric Authentication

Facial recognition and liveness detection to prevent identity theft & fraud.

Database Crosscheck

Access point to 70+ data partners and 300+ data sources around the world.

Smart Capture Technology

Reliable document authentication and extraction

Digital identity verification begins with smart capture technology analyzing the ID using ScreenlyyID’s template library, then cross-validates MRZ data and extracts details for verification.

Onboard Genuine Customers Only

Real people, every transaction

ScreenlyyID's, digital identity verification uses advanced liveness detection to prevent face spoofing from a single selfie, offering a seamless alternative to in-person checks.

Global Data Sources

Verify anyone's identity, anywhere, in seconds

ScreenlyyID's digital identity verification provides access to global data sources, enabling real-time checks to quickly onboard customers, prevent fraud, and ensure compliance.

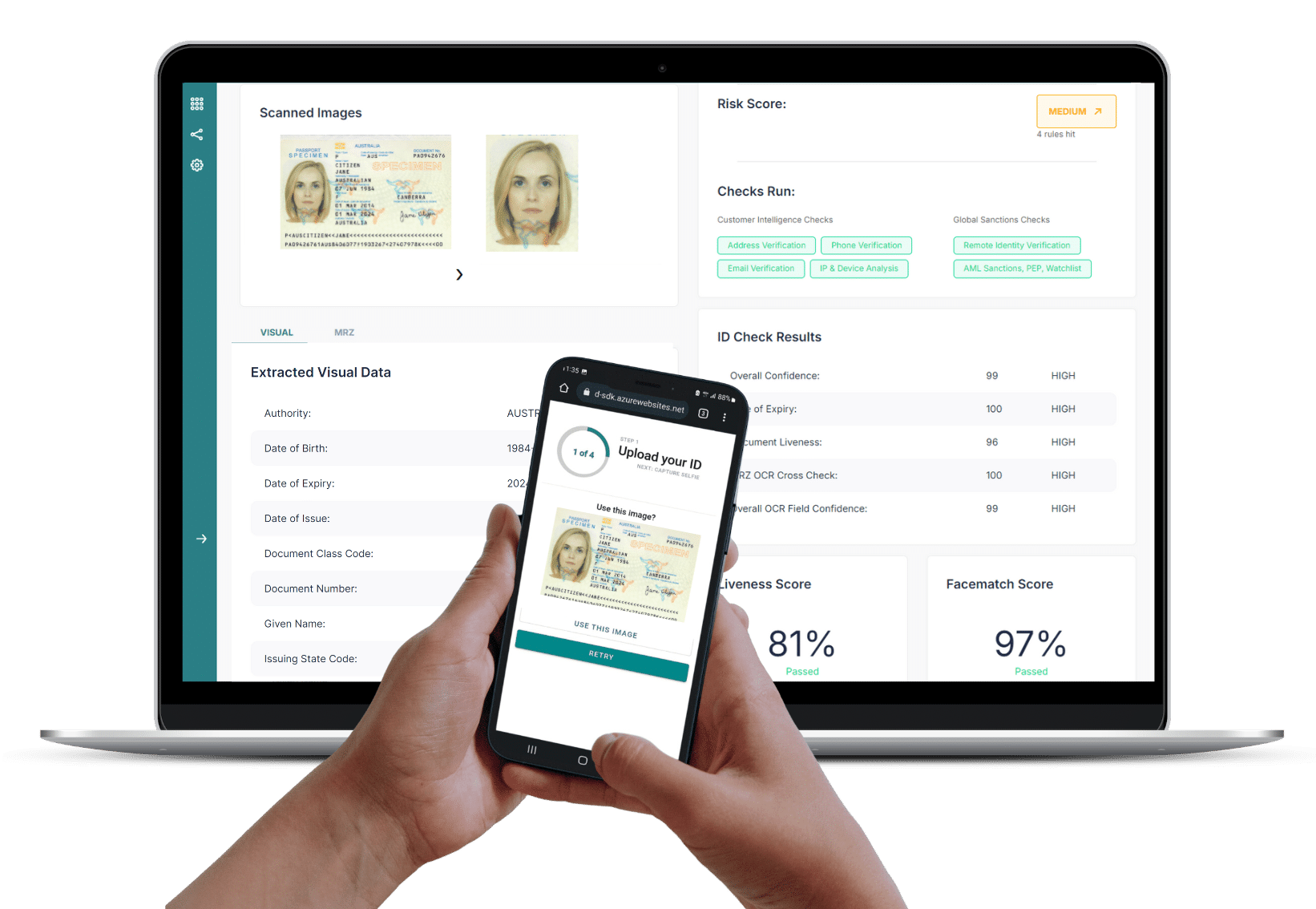

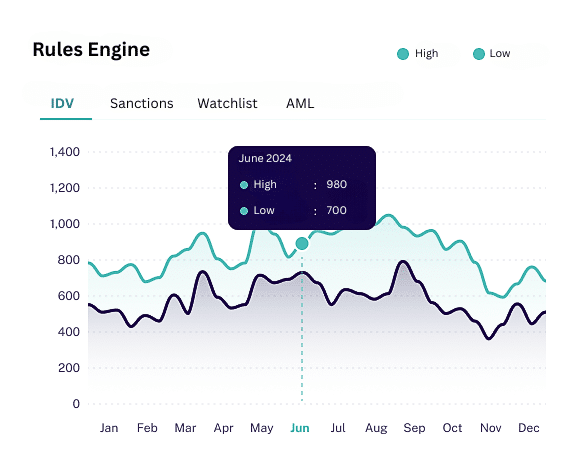

Automatic Rules Engine

Use risk indicators to validate new customers

Incorporate digital identity verification and risk indicators to identify synthetic identities and enhance KYC in real-time, without increasing user friction.

End-to-End Fraud Management & Customer Verification

Integrate ScreenlyyID Solutions for Complete Identity VerificationScreenlyyID solutions for full identity verification and anti-fraud protection.

Experience real-time analytics, seamless data integration, in-depth customer journey analysis, and powerful marketing tools.

eIDV Checks

Verify personal identity information against over 300+ independent and reliable data sources.

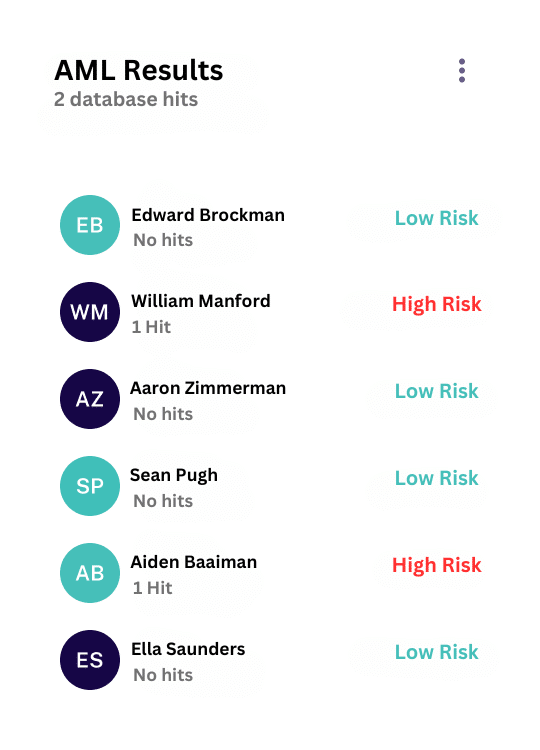

AML Screening

Use the extracted document data to run a full sanctions, PEP & global watchlist check on the individual.

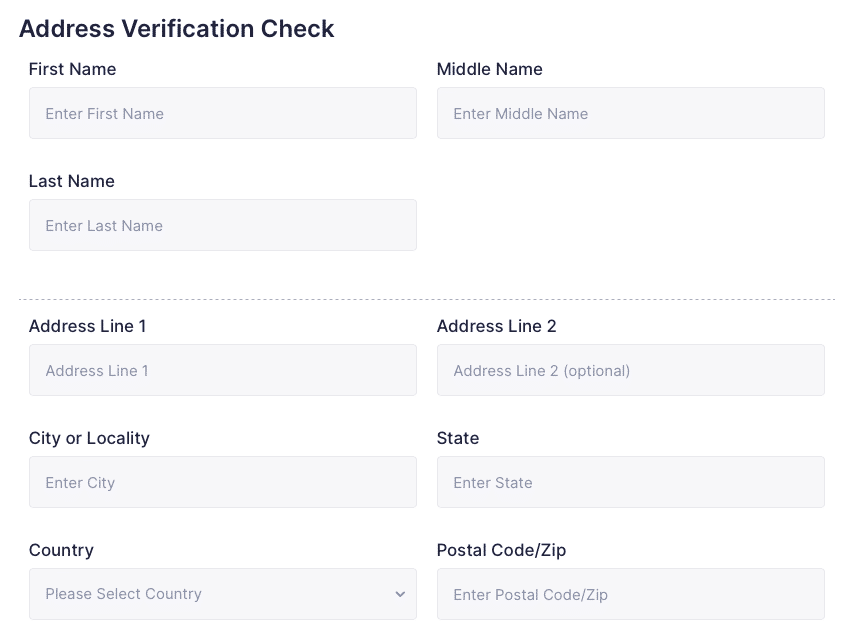

Address Validations

Validate and verify address’s in over 245 countries & territories. Simplify customer on-boarding, improve conversions.

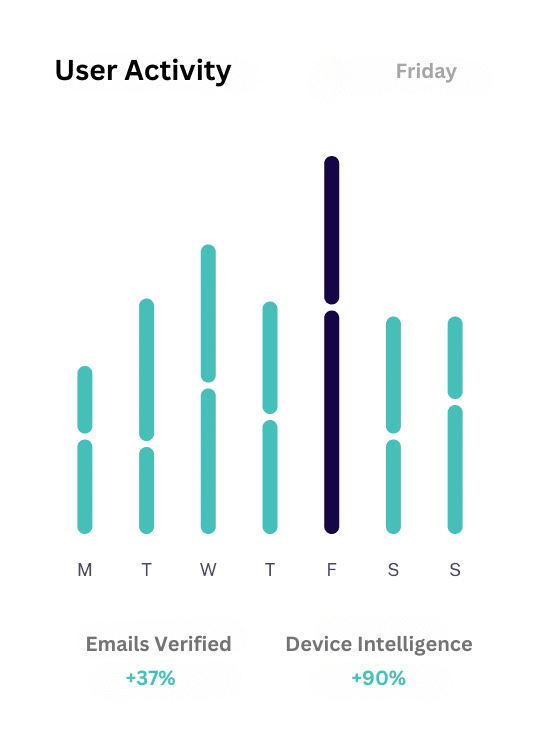

Email Validation

Validate Email Addresses in real time Reduce fraud and verify real users.

Phone Validation

Define each stage of work to see what’s important and where things are getting stuck.

IP & Device Fingerprinting

Identify suspicious users by detecting harmful IP's, detect malware, attack sources, bots and botnets.

More Features

Unleash advanced KYC verification capabilities

Experience real-time analytics, no code integrations, advanced risk assessment, and powerful APIs to manage your organizations KYC Verification.

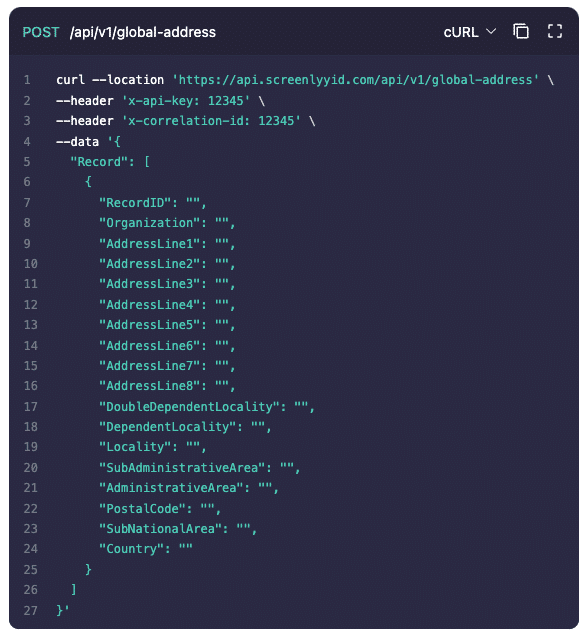

Simplified eIDV Process

No-Code, Bulk CSV, API, or live lookup, we’ve got you covered

ScreenlyyID's dashboard and API suite offers flexible integration options. You can conduct bulk verifications via CSV in the dashboard, integrate the API into your own systems, or send a no-code UI form to prospects for easy completion.

Frequently Asked Questions

We're here to answer all your questions

Everything you need to know about digital identity verification. Can’t find the answer you’re looking for? Please chat to our friendly team.

Digital identity verification is the process of confirming a person's identity using advanced technologies like AI and biometric data to ensure they are who they claim to be.

ScreenlyyID uses advanced AI to verify personal information by cross-checking external databases, analyzing documents, and performing biometric checks. This ensures a fast, secure onboarding process for users.

ScreenlyyID supports over 14,000 ID types from 245 countries and territories.

ScreenlyyID technology, detects fake IDs, presentation attacks, and uses liveness detection to prevent face spoofing. ScreenlyyID is also able to cross reference personal identity information against external data sources.

Contact Us

Talk to an expert

Let's connect to discuss the possibilities and find the perfect solution for your business needs.

Complete the form, and one of our experts will reach out to you. You'll discover how our solutions can tackle your specific challenges, optimize your operations, and drive your growth.

- Explore industry-specific use cases

- Identify the best solution for you

- Get enterprise pricing

- Book a demo

Lets Connect....

Start Today

Start Verifying Customers Today

See how easily ScreenlyyID integrates verification into your onboarding process.

- Free Forever

- No Set Up Fees

- No Licencing Fees

- No Hosting Fees