BIN Lookup - Bank Issuer Identification Number

The ideal solution for fraud protection and payment analysis, our BIN Lookup tool cross-checks credit card details with related data points, like the issuer's location versus the customer’s shipping address, to ensure accuracy and security.

- Setup in Minutes

- No Credit Card

- Cancel Anytime

High-Risk Customers

Real time BIN Lookup API tool

BIN Lookup allows fraud managers to identify suspicious behaviour and customers, mitigating the risk of fraud in real time.

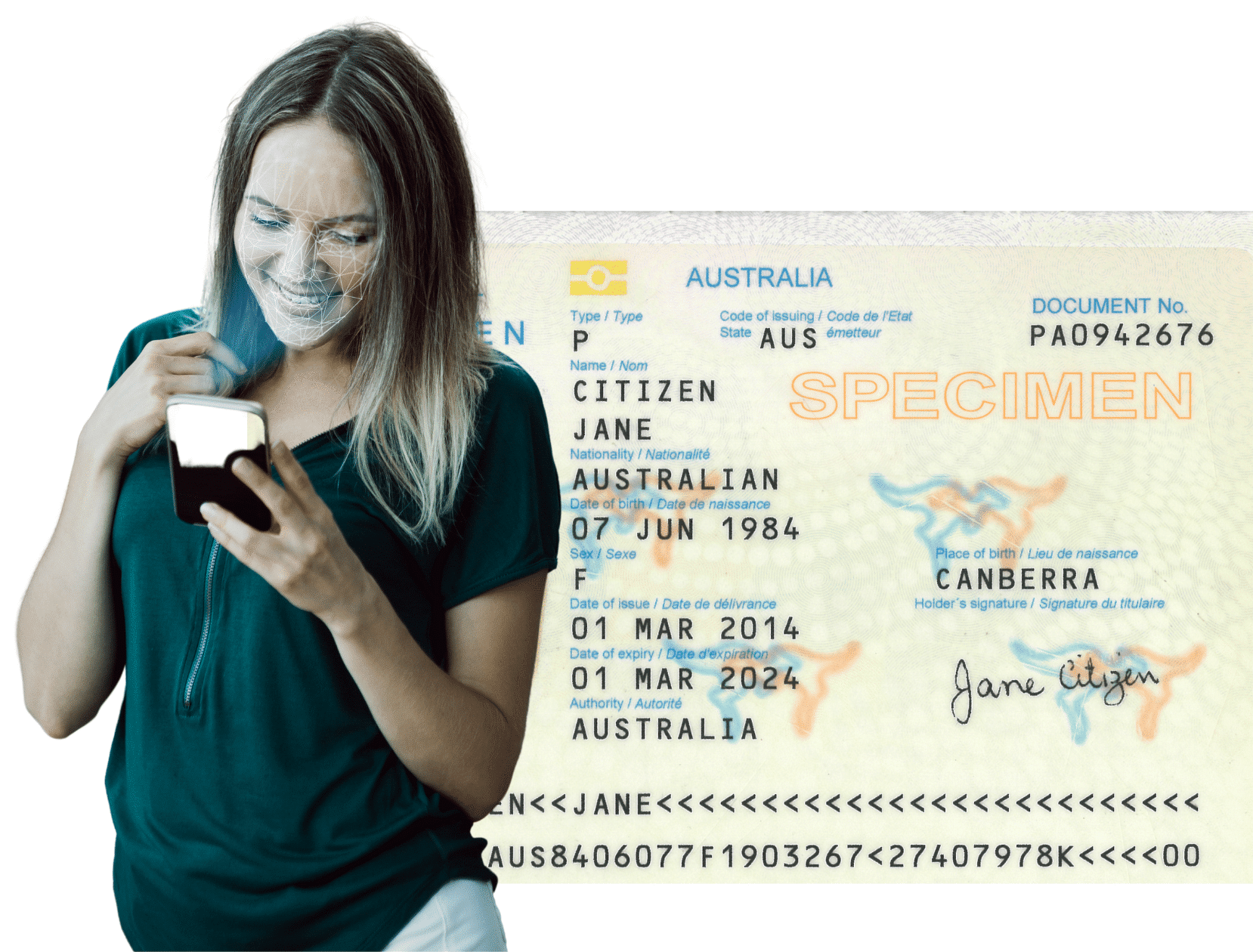

Extensive Identity Document Database

What is a BIN - Bank Issuer Identification Number

A BIN (Bank Issuer Identification Number) is a unique code assigned to each card-issuing institution. It identifies the bank behind a credit or debit card.

The BIN lookup is a useful fraud prevention tool that can reveal:

- Is the BIN valid?

- The name of the cardholder’s bank.

- The card type, e.g. credit, debit, pre paid charge card.

- The card brand, e.g. Mastercard, Visa, Discovery, American Express.

- The card category. The most common are classic, business, corporate, platinum and pre-paid

- The issuing bank country.

- The bank website and phone number details..

Match Critical Data Points

Why include BIN Lookup in your fraud protection strategy

ScreenlyyID's BIN lookup cross-references card details with collected data, helping to identify suspicious activity and reduce credit card fraud.

Detect Malicious or Dangerous IP Addresses

BIN Lookup:

Provides additional fraud detection measures

Utilize the ScreenlyyID BIN Lookup API to:

Comprehensive BIN Lookup Database

Our BIN database is comprehensive, updated weekly and works with 6, 8 and 10 digit BINs from all countries.

- Updated Weekly Database

- Supports Global BINs

- Accurate BIN Matching

- Risk Score

Assess New Users' Risk

BIN Lookup: Combat fraudulent users on a large scale

Real-Time Identity and Behavioral Risk Indicators

BIN Lookup: Instantly validate new identities identities

Ensure verification with certainty. Incorporate real-time digital identity and behavioral risk indicators into registration processes. Identify synthetic identities and enhance Know Your Customer (KYC) verifications without heightening user friction.

Stop Promo Abuse

BIN Lookup: Close promo abuse loopholes

Eliminate Fraud

The ScreenlyyID fraud management

and preventions solution

ScreenlyyID email validation will help your organization eliminate all fraud related threats.

End-to-End Fraud Management & Customer Verification

Combine with other ScreenlyyID solutions for full identity verification and anti-fraud protection.

Experience real-time analytics, seamless data integration, in-depth customer journey analysis, and powerful marketing tools.

Digital Identity Verification

effectively verify new customers in seconds, safeguarding your business from identity fraud

eIDV Checks

Verify personal identity information against over 300+ independent and reliable data sources.

AML Screening

Use the extracted document data to run a full sanctions, PEP & global watchlist check on the individual.

Address Validations

Validate and verify address’s in over 245 countries & territories. Simplify customer on-boarding, improve conversions.

Phone Validation

Define each stage of work to see what’s important and where things are getting stuck.

IP & Device Fingerprinting

Identify suspicious users by detecting harmful IP's, detect malware, attack sources, bots and botnets.

More Features

Unleash advanced KYC verification capabilities

Experience real-time analytics, no code integrations, advanced risk assessment, and powerful APIs to manage your organizations KYC Verification.

Frequently Asked Questions

We're here to answer all yourBIN Lookup questions

Everything you need to know about ScreenlyyID's BIN Lookup solution. Can’t find the answer you’re looking for? Please chat to our friendly team.

BIN Lookup is a service that provides detailed information about a bank identification number (BIN), which is the first 6 to 8 digits of a credit or debit card number. This information can include the issuing bank, card type, and country of origin.

No, BIN Lookup does not provide personal information about the cardholder. It only provides details about the card issuer, type, and country of origin, ensuring compliance with privacy regulations.

ScreenlyyID's BIN Lookup API includes additional fraud detection measures when a customer's IP address is provided. It performs IP geolocation and blocklist lookups, enhancing overall fraud prevention capabilities.

Contact Us

Talk to an expert

Let's connect to discuss the possibilities and find the perfect solution for your business needs.

Complete the form, and one of our experts will reach out to you. You'll discover how our solutions can tackle your specific challenges, optimize your operations, and drive your growth.

- Explore industry-specific use cases

- Identify the best solution for you

- Get enterprise pricing

- Book a demo

Lets Connect....

Start Today

Start Verifying Customers Today

See how easily ScreenlyyID integrates verification into your onboarding process.

- Free Forever

- No Set Up Fees

- No Licencing Fees

- No Hosting Fees