AML Compliance: Protect Your Business Through Screening and Monitoring

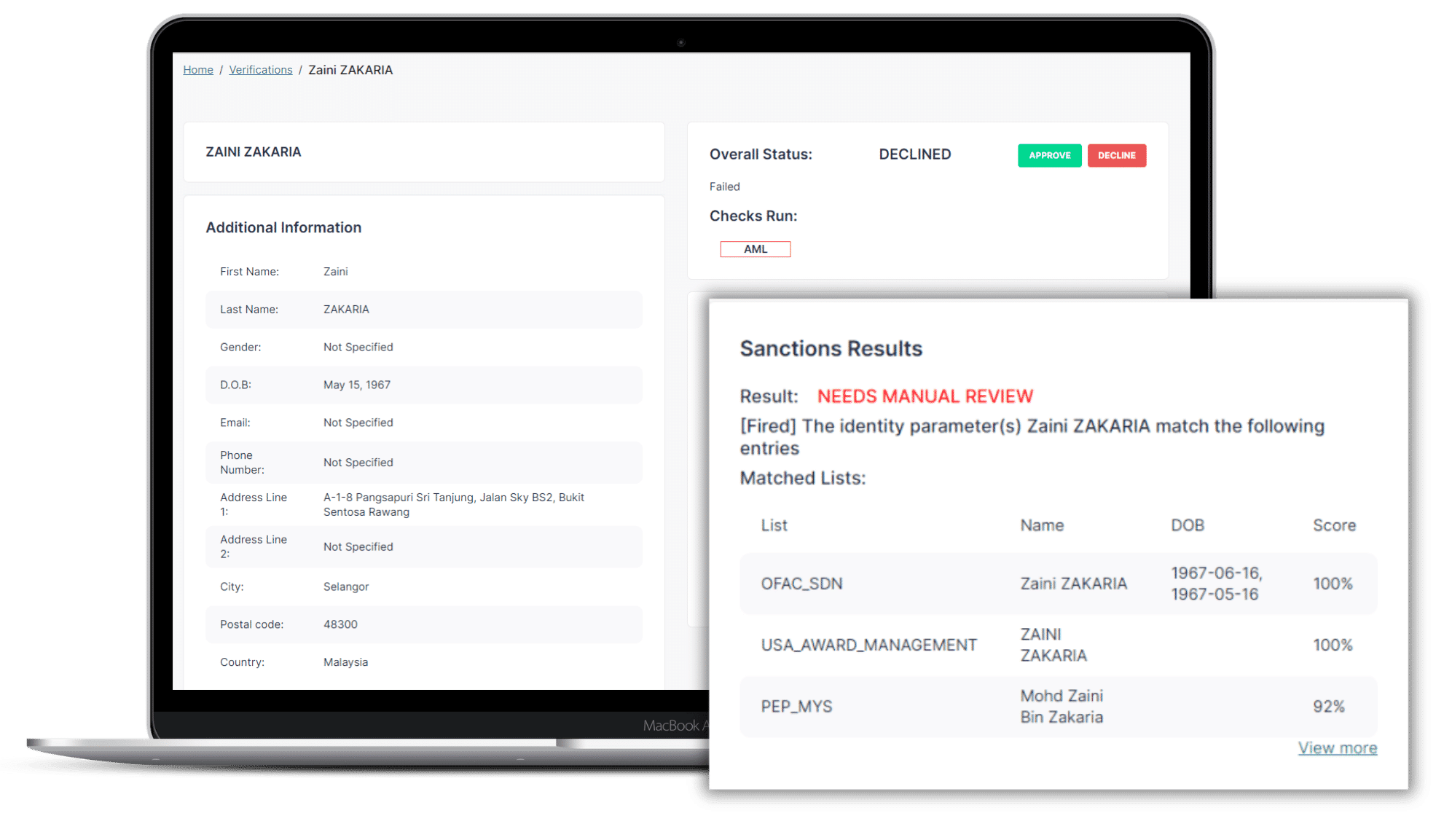

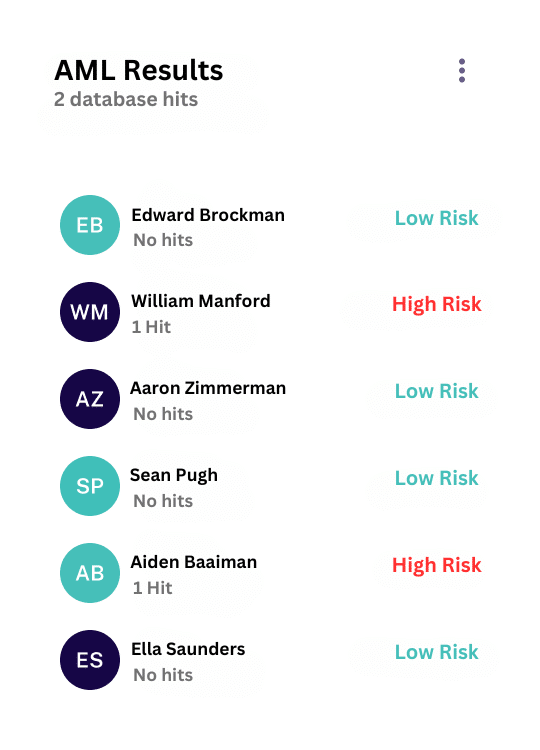

Screen customers against sanctions lists, politically exposed persons (PEP), and global watchlists to mitigate risk.

- Setup in Minutes

- No Credit Card

- Cancel Anytime

Comprehensive Customer Insights

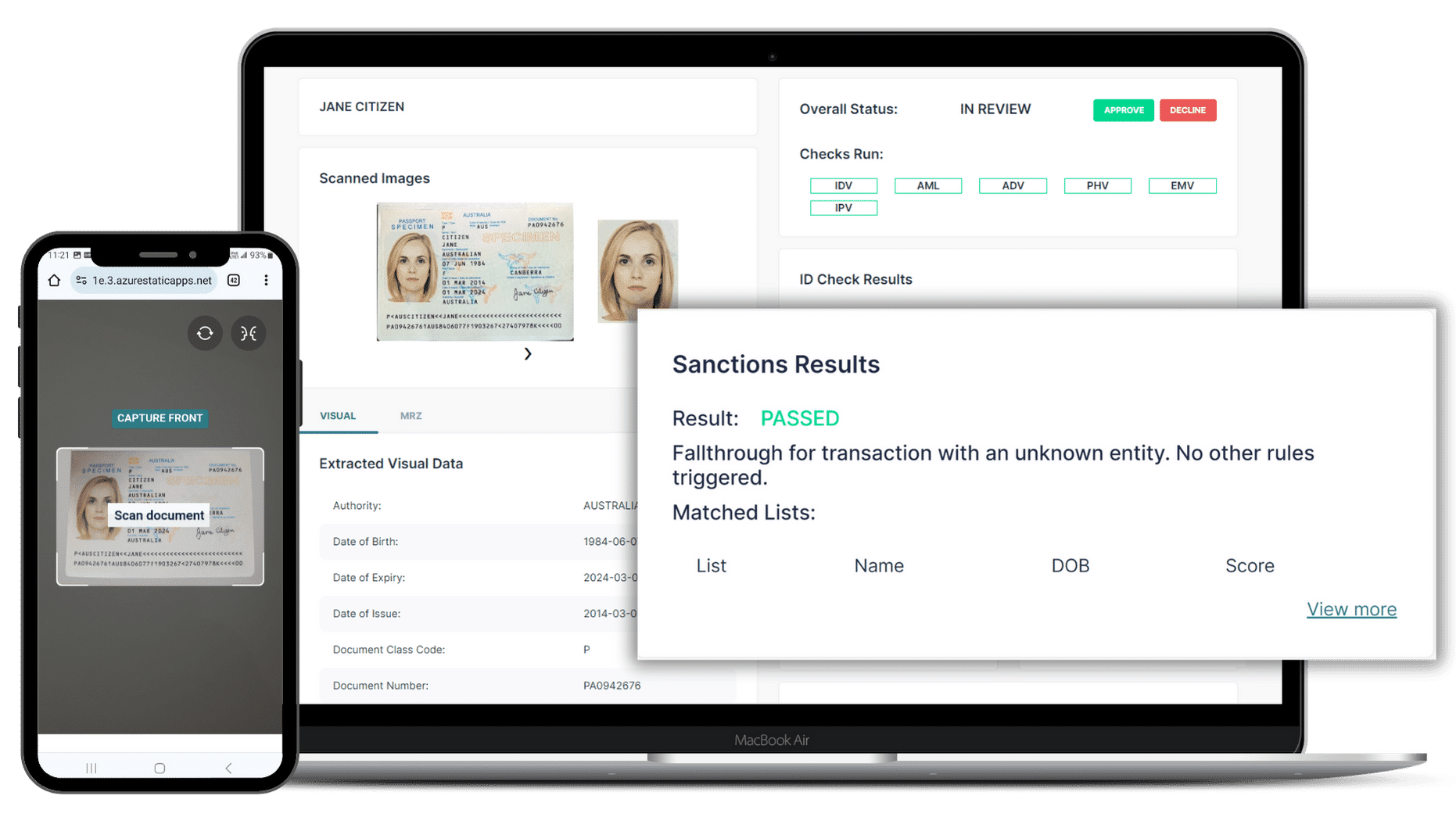

AML compliance: Automated screening with

seamless user onboarding

Enhance your AML compliance with automated screening. ScreenlyyID combines KYC verification with AML compliance screening for confident risk decisions.

Streamlined AML Compliance Screening

AML compliance: Your unified platform for regulatory screening

ScreenlyyID integrates essential compliance tools into a single, powerful platform:

- Centralized customer information

- Unified CDD data in the Manifest

- Visual compliance indicators

- Automated IDV integration

Simplified AML Compliance

AML compliance: Enhanced onboarding with minimized risk

Maintain strong AML compliance without friction. Our automated tools protect your business while ensuring smooth legitimate user onboarding.

Regulatory Technology Solutions

AML compliance: Automated screening for modern businesses

Transform your compliance workflow with ScreenlyyID's intelligent AML compliance and KYC platform. Automate checks, reduce risk, and accelerate customer onboarding.

Smart Automation Tools

AML compliance: simplified through technology

Our AML compliance platform streamlines complex screening processes with real-time monitoring, automated risk scoring, and seamless API integration.

Smart Automation Tools

AML compliance: simplified through technology

Our AML compliance platform streamlines complex screening processes with real-time monitoring, automated risk scoring, and seamless API integration.

Than automated solutions, with financial institutions spending approximately $213 per customer on manual KYC checks.

The average time an organization spend on manual reviews, compared to just 15-30 minutes with automated systems.

Of customers abandoning applications, due to lengthy manual verification processes

Business Protection

AML compliance that scales with your business

Cut manual review time by 60% while strengthening your compliance framework. Advanced algorithms detect high-risk entities faster, keeping your business protected.

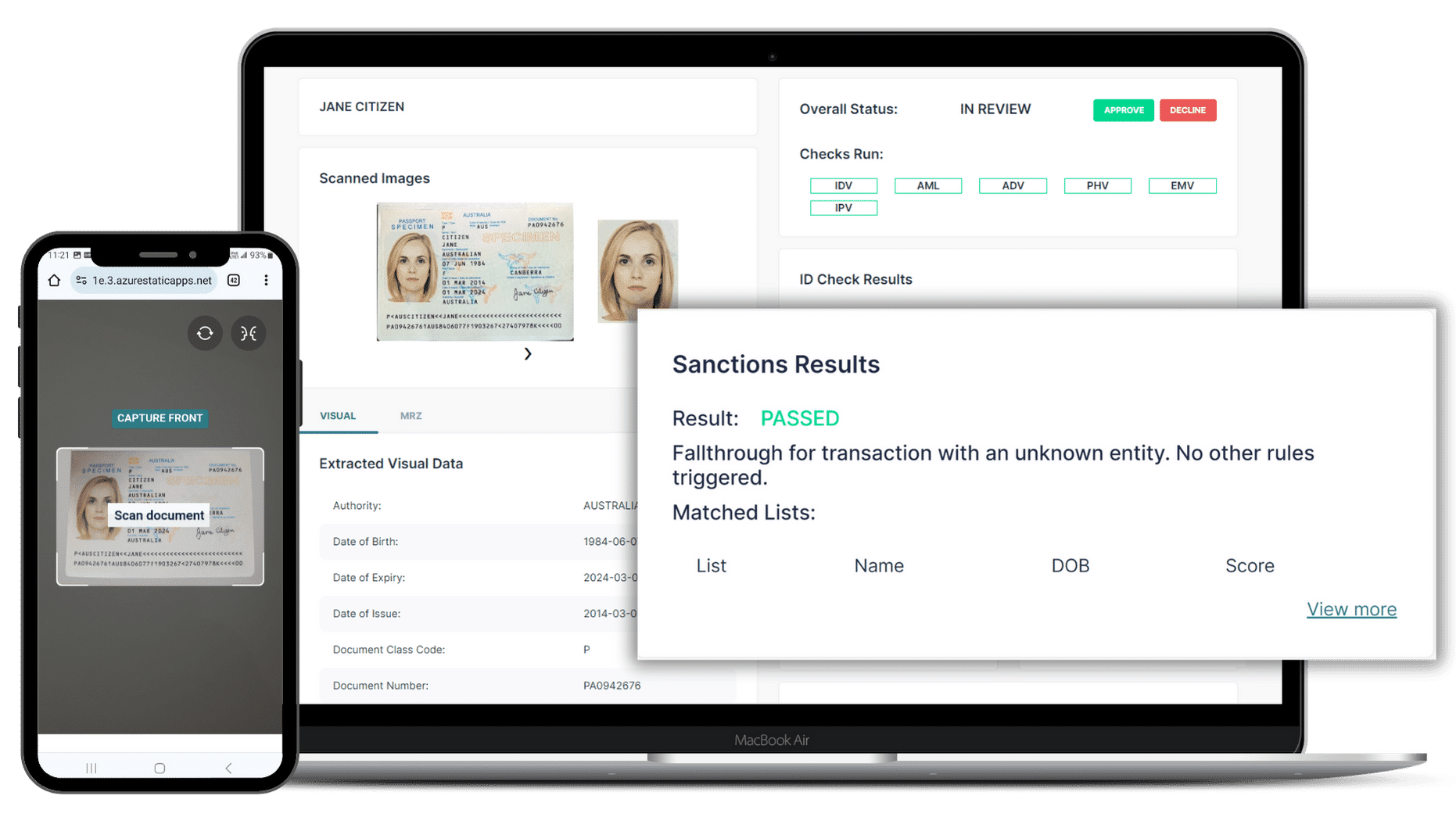

Comprehensive Coverage

End-to-end AML screening platform

Access sanctions. global watchlists, automated PEP screening. Get complete visibility of your compliance operations through a single dashboard.

Return on Investment

The cost of not taking action speaks loudly

In 2023, global AML fines totalled $5.4 billion, with an average penalty of $45 million per violation, highlighting the severe consequences of compliance failures.

Than automated solutions, with financial institutions spending approximately $213 per customer on manual KYC checks.

The average time an organization spend on manual reviews, compared to just 15-30 minutes with automated systems.

Of customers abandoning applications, due to lengthy manual verification processes

End-to-End Fraud Management & Customer Verification

Combine with other ScreenlyyID solutions for full identity verification and anti-fraud protection.

Experience real-time analytics, seamless data integration, in-depth customer journey analysis, and powerful marketing tools.

Digital Identity Verification

effectively verify new customers in seconds, safeguarding your business from identity fraud

eIDV Checks

Verify personal identity information against over 300+ independent and reliable data sources.

Email Validation

Validate Email Addresses in real time Reduce fraud and verify real users.

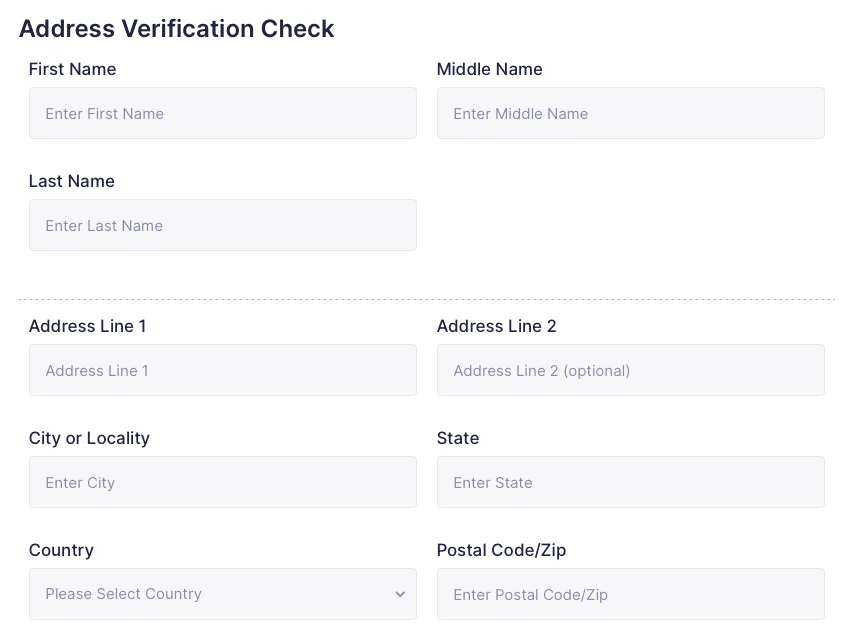

Address Validations

Validate and verify address’s in over 245 countries & territories. Simplify customer on-boarding, improve conversions.

Phone Validation

Define each stage of work to see what’s important and where things are getting stuck.

IP & Device Fingerprinting

Identify suspicious users by detecting harmful IP's, detect malware, attack sources, bots and botnets.

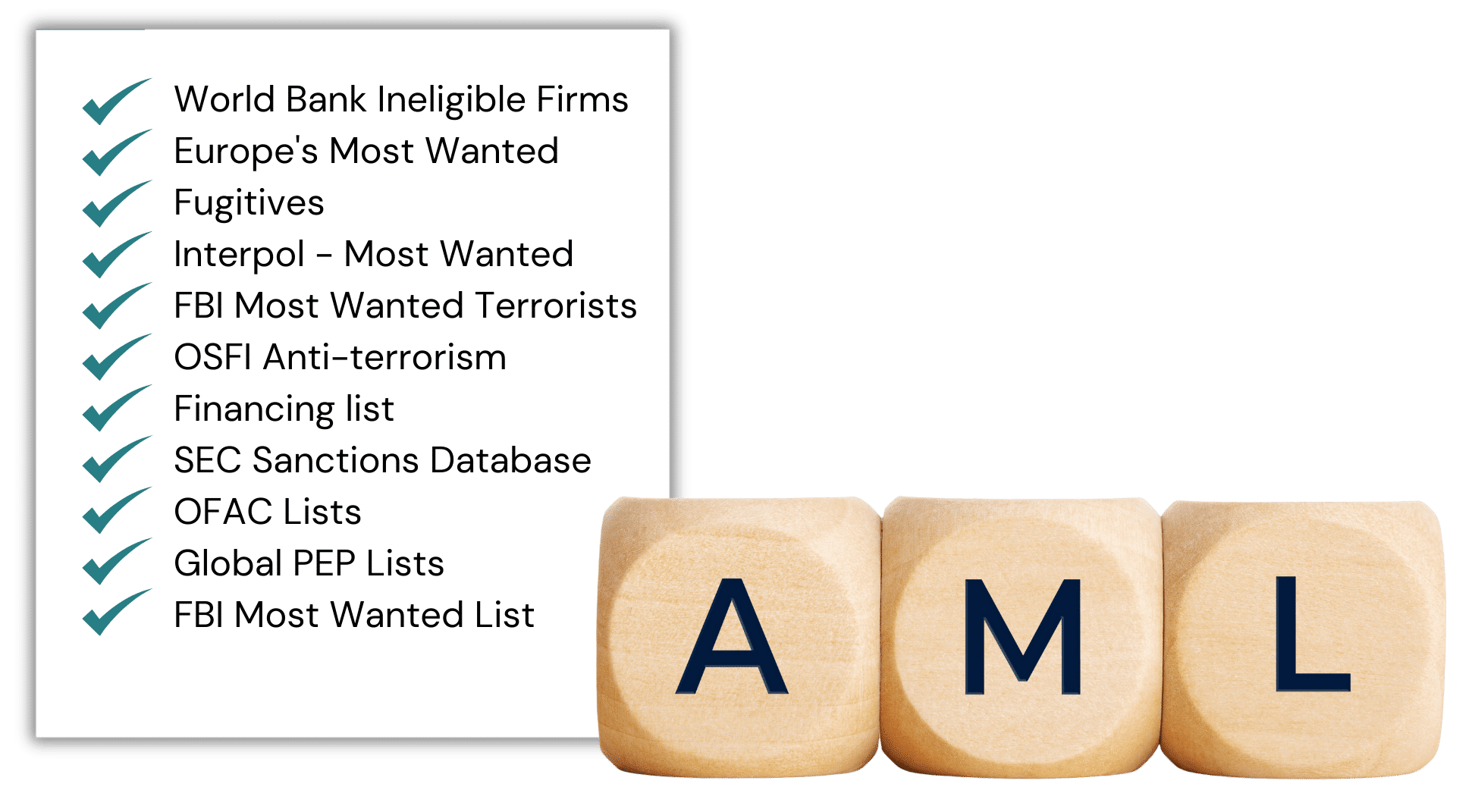

Simplified eIDV Process

No-Code, Bulk CSV, API, or live lookup, we’ve got you covered

ScreenlyyID's dashboard and API suite offers flexible integration options. You can conduct bulk verifications via CSV in the dashboard, integrate the API into your own systems, or send a no-code UI form to prospects for easy completion.

More Features

Unleash advanced KYC verification capabilities

Experience real-time analytics, no code integrations, advanced risk assessment, and powerful APIs to manage your organizations KYC Verification.

Case management

Advanced case management capabilities to ensure efficient handling within your team.

Risk engine

Pre-built rule sets that assess risk at every turn, and minimize manual work.

No code necessary

Stay compliant and minimize fraud without writing a single line of code.

Automated reporting

Submit compliance reports with ease with full data exports to pdf and AI summaries.

Powerful API & SDKs

Integrate applications or develop custom flows with our advanced APIs and SDKs.

Frequently Asked Questions

We're here to answer all your questions

Everything you need to know about ScreenlyyID's AML screening. Can’t find the answer you’re looking for? Please chat to our friendly team.

ScreenlyyID combines automated AML screening with KYC verification in a single platform, reducing the need for multiple systems. Our solution offers real-time monitoring, automated risk scoring, and integrates seamlessly with your existing workflow.

Or you can run a check directly from our dashboard.

Yes, our platform is built to scale. Whether you're screening hundreds or thousands of profiles daily, our automated system maintains consistent performance while reducing manual review time by up to 60%.

Contact Us

Talk to an expert

Let's connect to discuss the possibilities and find the perfect solution for your business needs.

Complete the form, and one of our experts will reach out to you. You'll discover how our solutions can tackle your specific challenges, optimize your operations, and drive your growth.

- Explore industry-specific use cases

- Identify the best solution for you

- Get enterprise pricing

- Book a demo

Lets Connect....

Start Today

Start Verifying Customers Today

See how easily ScreenlyyID integrates verification into your onboarding process.

- Free Forever

- No Set Up Fees

- No Licencing Fees

- No Hosting Fees